The idea of Financial Independence, Retire Early (FIRE) usually comes wrapped in two extreme images. One is the ultra-frugal guru living on rice and beans. The other is the lucky tech worker who cashed out early. Both miss the point for most people. The real story of achieving FIRE today is about the smart tools you use to take control.

Everyone hears the same FIRE starter pack: save most of your money, put it in index funds, and follow the 4% rule. It sounds simple on paper. Then you open a brokerage account and stare at the screen.

Where do you click first? How do you know you won’t mess it up? This is the moment many plans freeze. You have the map in your hand, but no idea how to drive the car. The real challenge isn’t memorizing the rules. You need to find the training wheels that build your confidence.

Now, a new wave of platforms is changing this. They are built specifically to turn the grand FIRE vision into a series of manageable, actionable steps. They act as your personal financial workshop, your planning cockpit, and your investment guide all in one. These tools don’t just give you information.

They give you a system for applying it. This article explores how these platforms simplify the complex parts of the FIRE journey, helping you move from aspiration to action faster than ever before.

Featured FIRE Platforms

| Platform | Core Function | Best For |

| Finelo | Financial Education & Investing Simulator | Beginners needing foundational knowledge and risk-free practice. |

| WeFIRE | Personalized FIRE Planning & Tracking | Individuals who want a dedicated, app-based dashboard to find and track their FIRE number. |

| Boldin | Deep-Dive Retirement Modeling | Those with complex financial pictures who want to model detailed scenarios and stress-test their plans. |

| Spaceship | Accessible Investing | New investors looking for a simple, user-friendly platform to start executing their investment strategy. |

| LXME | Targeted Financial Planning for Women | Women seeking a tailored approach and community support on their FIRE journey. |

The Practice Field: Finelo’s Simulated Path to Financial Confidence

Finelo.com works like a flight simulator for your finances. Instead of risking your savings on day one, you get a virtual portfolio with play money. The platform feeds you real market data for over 120 different assets. You can buy, sell, and watch your pretend investments move with the market. You can learn the ropes without your bank account taking the hit.

This simulator sits at the center of a library of short, interactive lessons. They break down everything from stocks to crypto into digestible pieces. An AI helper pops up to answer questions as you learn.

People reviewing the app often mention this low-pressure environment. They say it finally made things click, giving them the guts to later invest their own cash.

The Financial Control Room: WeFIRE’s Personalized FIRE Dashboard

Knowing you need a large savings goal is one thing. Watching a dynamic plan come together is another. This is where a platform like WeFIRE excels. It acts as a central command center, moving your early retirement vision from an abstract number to a living, adaptable strategy.

WeFIRE provides a structured framework to build your personalized plan. It guides you through defining your vision, calculating your specific “FIRE number,” and creating a step-by-step strategy to get there.

The platform uses a cash flow approach for its calculations, which can offer a more flexible and personalized withdrawal strategy than a static rule of thumb, helping you enjoy retirement while maintaining financial security. For those who find spreadsheets intimidating, WeFIRE’s guided, app-based environment can make complex financial modeling feel more manageable.

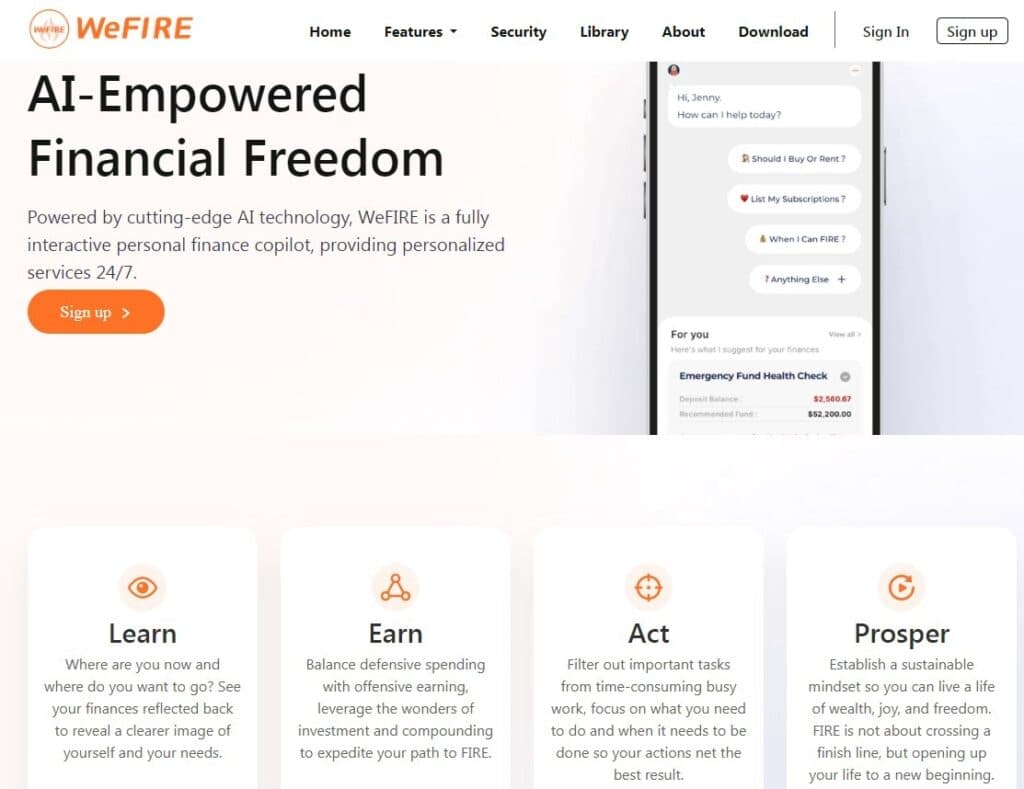

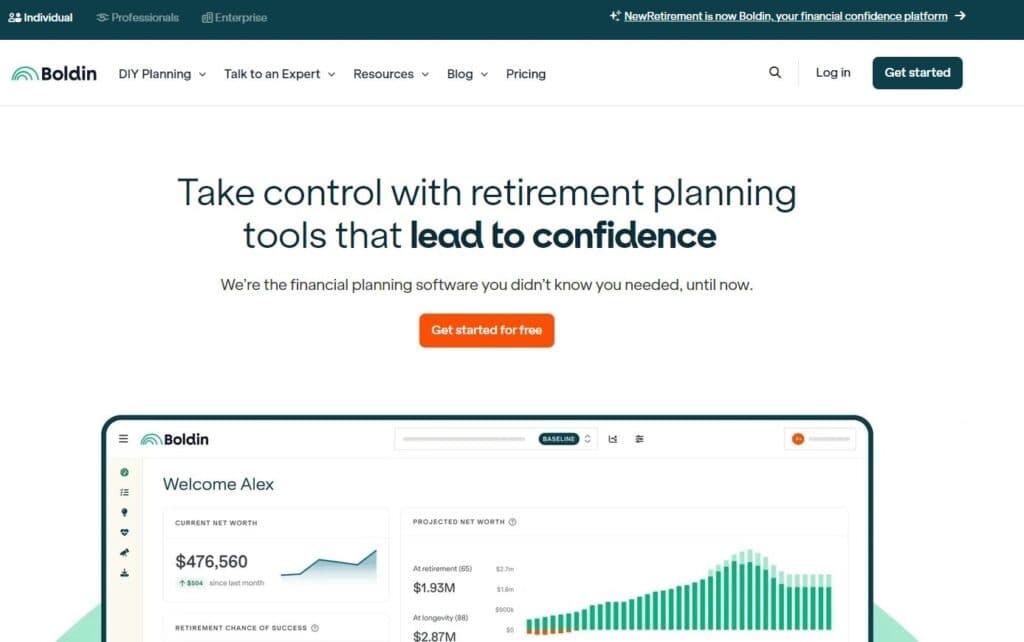

The Automated Engine: Boldin’s Deep-Dive Retirement Modeling

Once you have a solid plan, the next step is to test its resilience. Boldin is a comprehensive retirement planning system designed for this kind of deep analysis. It’s built for individuals who want to move beyond basic assumptions and model their financial future with precision.

Boldin invites you to get brutally specific with your future. Its planner lets you forecast your spending across dozens of life categories, year by year. Think about how your costs for health, travel, or hobbies might shift over time. Then you can tweak the numbers. See what happens if you withdraw more in one year, or if the market takes a dip.

It shows you the outer limits of what your portfolio can handle. This isn’t just about a single number. It’s about testing how your financial plan holds up against life’s inevitable surprises. You get to poke and prod your strategy until it feels robust.

The Modern Launchpad: Spaceship’s Gateway to Accessible Investing

All the planning in the world means little if you never actually invest. This is where a platform like Spaceship (by eToro) comes in. It focuses on making the investment process feel simple. The idea is to remove the technical friction that often paralyzes new investors.

You can check their website for the latest tools, but the general vibe is about accessibility. Think easy-to-understand portfolios and clear tracking. For someone deep in the FIRE grind, it’s the mechanism that converts your monthly savings into a working portfolio. It turns your saved cash into a growing pile of assets, without requiring a finance degree to manage.

The Community-Powered Compass: LXME’s Targeted Guidance for Women

LXME builds a financial home for women. It recognizes that the journey can look different when you factor in things like the pay gap or career pauses. The platform mixes calculators with community, offering a space designed for these specific realities.

Its retirement calculator is a straightforward starting point. You plug in your age, your target retirement age, and your monthly spending. It then spits out a total number you need to save and a monthly investment figure.

That clear number gives you a solid place to start. LXME then suggests where to put your money, moving you from a frightening total to an initial amount you can handle. The platform breaks down a monumental task into a few simple moves you can make right now.

Final Thoughts: Your Shortcut Isn’t a Secret, It’s a System

Tackling FIRE alone with a spreadsheet can feel pretty lonely. These platforms act like a dedicated crew. Each one handles a different part of the ship.

You see how LXME builds a supportive community. You don’t have to sign up for every single service. Maybe you just need Finelo’s practice simulator right now. Later, you might lean on Boldin’s deep-number crunching. Your needs will change as you move forward.

Their main job is to replace that hopeful feeling with a clear set of actions. They hand you the tools to start building today, instead of waiting for someday. That shift from dreaming to doing changes everything.